What is the Nature of Poverty and Economic Hardship in the United States?

- What does it mean to experience poverty?

- How is poverty measured in the United States?

- Are Americans who experience poverty now better off than a generation ago?

- How accurate are commonly held stereotypes about poverty and economic hardship?

How Serious is the Problem of Economic Hardship for American Families?

- How many children in the U.S. live in families with low incomes?

- Are some children and families at greater risk for economic hardship than others?

- What are the effects of economic hardship on children?

Is it Possible to Reduce Economic Hardship among American Families?

- Why is there so much economic hardship in a country as wealthy as the U.S.?

- Why should Americans care about family economic hardship?

- What can be done to increase economic security for America’s children and families?

What is the Nature of Poverty and Economic Hardship in the United States?

1. What does it mean to experience poverty?

Families and their children experience poverty when they are unable to achieve a minimum, decent standard of living that allows them to participate fully in mainstream society. One component of poverty is material hardship. Although we are all taught that the essentials are food, clothing, and shelter, the reality is that the definition of basic material necessities varies by time and place. In the United States, we all agree that having access to running water, electricity, indoor plumbing, and telephone service are essential to 21st century living even though that would not have been true 50 or 100 years ago.

To achieve a minimum but decent standard of living, families need more than material resources; they also need “human and social capital.” Human and social capital include education, basic life skills, and employment experience, as well as less tangible resources such as social networks and access to civic institutions. These non-material resources provide families with the means to get by, and ultimately, to get ahead. Human and social capital help families improve their earnings potential and accumulate assets, gain access to safe neighborhoods and high-quality services (such as medical care, schooling), and expand their networks and social connections.

The experiences of children and families who face economic hardship are far from uniform. Some families experience hard times for brief spells while a small minority experience chronic poverty. For some, the greatest challenge is inadequate financial resources, whether insufficient income to meet daily expenses or the necessary assets (savings, a home) to get ahead. For others, economic hardship is compounded by social isolation. These differences in the severity and depth of poverty matter, especially when it comes to the effects on children.

2. How is poverty measured in the United States?

The U.S. government measures poverty by a narrow income standard — this measure does not include material hardship (such as living in substandard housing) or debt, nor does it consider financial assets (such as savings or property). Developed more than 40 years ago, the official poverty measure is a specific dollar amount that varies by family size but is the same across the continental U.S..

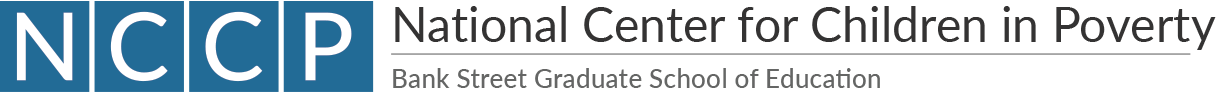

According to the federal poverty guidelines, the poverty level is $22,050 for a family of four and $18,310 for a family of three (see table). (The poverty guidelines are used to determine eligibility for public programs. A similar but more complicated measure is used for calculating poverty rates.)

The current poverty measure was established in the 1960s and is now widely acknowledged to be outdated. It was based on research indicating that families spent about one-third of their incomes on food — the official poverty level was set by multiplying food costs by three. Since then, the same figures have been updated annually for inflation but have otherwise remained unchanged.

Yet food now comprises only one-seventh of an average family’s expenses, while the costs of housing, child care, health care, and transportation have grown disproportionately. Most analysts agree that today’s poverty thresholds are too low. And although there is no consensus about what constitutes a minimum but decent standard of living in the U.S., research consistently shows that, on average, families need an income of about twice the federal poverty level to meet their most basic needs.

Failure to update the federal poverty level for changes in the cost of living means that people who are considered poor today by the official standard are worse off relative to everyone else than people considered poor when the poverty measure was established. The current federal poverty measure equals about 31 percent of median household income, whereas in the 1960s, the poverty level was nearly 50 percent of the median.

The European Union and most advanced industrialized countries measure poverty quite differently from the U.S. Rather than setting minimum income thresholds below which individuals and families are considered to be poor, other countries measure economic disadvantage relative to the citizenry as a whole, for example, having income below 50 percent of median.

3. Are Americans who experience poverty now better off than a generation ago?

Material deprivation is not as widespread in the United States as it was 30 or 40 years ago. For example, few Americans experience severe or chronic hunger, due in large part to public food and nutrition programs, such as food stamps, school breakfast and lunch programs, and WIC (the Special Supplemental Nutrition Program for Women, Infants, and Children). Over time, Social Security greatly reduced poverty and economic insecurity among the elderly. Increased wealth and technological advances have made it possible for ordinary families to have larger houses, computers, televisions, multiple cars, stereo equipment, air conditioning, and cell phones.

Some people question whether a family that has air conditioning or a DVD player should be considered poor. But in a wealthy nation such as the US, cars, computers, TVs, and other technologies are considered by most to be a normal part of mainstream American life rather than luxuries. Most workers need a car to get to work. TVs and other forms of entertainment link people to mainstream culture. And having a computer with access to the internet is crucial for children to keep up with their peers in school. Even air conditioning does more than provide comfort — in hot weather, it increases children’s concentration in school and improves the health of children, the elderly, and the chronically ill.

Consider as well the devastating effects of Hurricane Katrina. Prior to the hurricane, New Orleans had one of the highest child poverty rates in the country — 38 percent (and this figure would be much higher if it included families with incomes up to twice the official poverty level). One in five households in New Orleans lacked a car, and eight percent had no phone service. The pervasive social and economic isolation increased the loss of life from the hurricane and exacerbated the devastating effects on displaced families and children.

Focusing solely on the material possessions a family has ignores the other types of resources they need to provide a decent life for their children — a home in a safe neighborhood; access to good schools, good jobs and basic services; and less tangible resources such as basic life skills and support networks.

4. How accurate are commonly held stereotypes about poverty?

The most commonly held stereotypes about poverty are false. Family poverty in the U.S. is typically depicted as a static, entrenched condition, characterized by large numbers of children, chronic unemployment, drugs, violence, and family turmoil. But the realities of poverty and economic hardship are very different.

Americans often talk about “poor people” as if they are a distinct group with uniform characteristics and somehow unlike the rest of “us.” In fact, there is great diversity among children and families who experience economic hardship. Research shows that many stereotypes just aren’t accurate: a study of children born between 1970 and 1990 showed that 35 percent experienced poverty at some point during their childhood; only a small minority experienced persistent and chronic poverty. And more than 90 percent of low-income single mothers have only one, two, or three children.

Although most portrayals of poverty in the media and elsewhere reflect the experience of only a few, a significant portion of families in America have experienced economic hardship, even if it is not life-long. Americans need new ways of thinking about poverty that allow us to understand the full range of economic hardship and insecurity in our country. In addition to the millions of families who struggle to make ends meet, millions of others are merely one crisis — a job loss, health emergency, or divorce — away from financial devastation, particularly in this fragile economy. A recent study showed that the majority of American families with children have very little savings to rely on during times of crisis. Recently, more and more families have become vulnerable to economic hardship.

How Serious is the Problem of Economic Hardship for American Families?

5. How many children in the US live in families with low incomes?

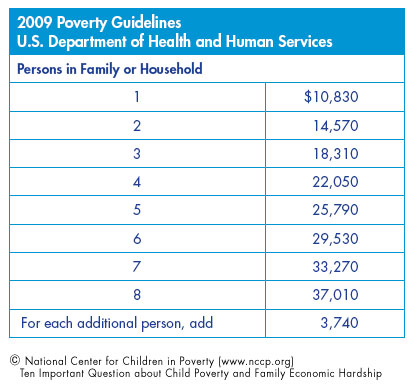

Given that official poverty statistics are deeply flawed, the National Center for Children in Poverty uses “low income” as one measure of economic hardship. Low income is defined as having income below twice the federal poverty level — the amount of income that research suggests is needed on average for families to meet their basic needs. About 41 percent of the nation’s children — nearly 30 million in 2008 — live in families with low incomes, that is, incomes below twice the official poverty level (for 2009, about $44,000 for a family of four).

Although families with incomes between 100 and 200 percent of the poverty level are not officially classified as poor, many face material hardships and financial pressures similar to families with incomes below the poverty level. Missed rent payments, utility shut offs, inadequate access to health care, unstable child care arrangements, and running out of food are not uncommon for such families.

Low-income rates for young children are higher than those for older children — 44 percent of children under age six live in low-income families, compared to 39 percent of children over age six. Parents of younger children tend to be younger and to have less education and work experience than parents of older children, so their earnings are typically lower.

6. Are some children and families at greater risk for economic hardship than others?

Low levels of parental education are a primary risk factor for being low income. Eighty-three percent of children whose parents have less than a high school diploma live in low-income families, and over half of children whose parents have only a high school degree are low income as well. Workers with only a high school degree have seen their wages stagnate or decline in recent decades while the income gap between those who have a college degree and those who do not has doubled. Yet only 27 percent of workers in the U.S. have a college degree.

Single-parent families are at greater risk of economic hardship than two-parent families, largely because the latter have twice the earnings potential. But research indicates that marriage does not guarantee protection from economic insecurity. More than one in four children with married parents lives in a low-income family. In rural and suburban areas, the majority of low-income children have married parents. And among Latinos, more than half of children with married parents are low income. Moreover, most individuals who experience poverty as adults grew up in married-parent households.

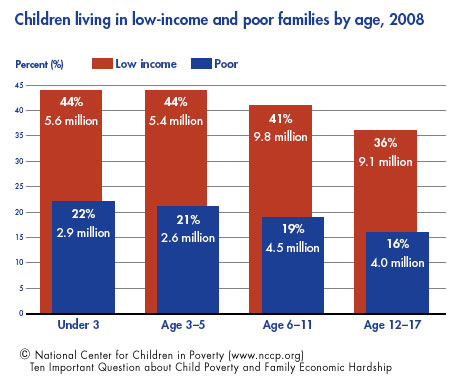

Although low-income rates for minority children are considerably higher than those for white children, this is due largely to a higher prevalence of other risk factors, for example, higher rates of single parenthood and lower levels of parental education and earnings. About 61 percent of black, 62 percent of Latino children and 57 percent of American Indian children live in low-income families, compared to about 27 percent of white children and 31 percent of Asian children. At the same time, however, whites comprise the largest group of low-income children: 11 million white children live in families with incomes below twice the federal poverty line.

Having immigrant parents also increases a child’s chances of living in a low-income family. More than 20 percent of this country’s children — about 16 million — have at least one foreign-born parent. Sixty percent of children whose parents are immigrants are low-income, compared to 37 percent of children whose parents were born in the U.S.

7. What are the effects of economic hardship on children?

Economic hardship and other types of deprivation can have profound effects on children’s development and their prospects for the future — and therefore on the nation as a whole. Low family income can impede children’s cognitive development and their ability to learn. It can contribute to behavioral, social, and emotional problems. And it can cause and exacerbate poor child health as well. The children at greatest risk are those who experience economic hardship when they are young and children who experience severe and chronic hardship.

It is not simply the amount of income that matters for children. The instability and unpredictability of low-wage work can lead to fluctuating family incomes. Children whose families are in volatile or deteriorating financial circumstances are more likely to experience negative effects than children whose families are in stable economic situations.

The negative effects on young children living in low income families are troubling in their own right. These effects are also cause for concern because they are associated with difficulties later in life — dropping out of school, poor adolescent and adult health, poor employment outcomes and experiencing poverty as adults. Stable, nurturing, and enriching environments in the early years help create a sturdy foundation for later school achievement, economic productivity, and responsible citizenship.

Parents need financial resources as well as human and social capital (basic life skills, education, social networks) to provide the experiences, resources, and services that are essential for children to thrive and to grow into healthy, productive adults — high-quality health care, adequate housing, stimulating early learning programs, good schools, money for books, and other enriching activities. Parents who face chronic economic hardship are much more likely than their more affluent peers to experience severe stress and depression — both of which are linked to poor social and emotional outcomes for children.

Is it Possible to Reduce Economic Hardship for American Families?

8. Why is there so much economic hardship in a country as wealthy as the U.S.?

Given its wealth, the U.S. had unusually high rates of child poverty and income inequality, even prior to the current economic downturn. These conditions are not inevitable — they are a function both of the economy and government policy. In the late 1990s, for example, there was a dramatic decline in low-income rates, especially among the least well off families. The economy was strong and federal policy supports for low-wage workers with children — the Earned Income Tax Credit, public health insurance for children, and child care subsidies — were greatly expanded. In the current economic downturn, it is expected that the number of poor children will increase by millions.

Other industrialized nations have lower poverty rates because they seek to prevent hardship by providing assistance to all families. These supports include “child allowances” (typically cash supplements), child care assistance, health coverage, paid family leave, and other supports that help offset the cost of raising children.

But the U.S. takes a different policy approach. Our nation does little to assist low-income working families unless they hit rock bottom. And then, such families are eligible only for means-tested benefits that tend to be highly stigmatized; most families who need help receive little or none. (One notable exception is the federal Earned Income Tax Credit.)

At the same time, middle- and especially upper-income families receive numerous government benefits that help them maintain and improve their standard of living — benefits that are largely unavailable to lower-income families. These include tax-subsidized benefits provided by employers (such as health insurance and retirement accounts), tax breaks for home owners (such as deductions for mortgage interest and tax exclusions for profits from home sales), and other tax preferences that privilege assets over income. Although most people don’t think of these tax breaks as government “benefits,” they cost the federal treasury nearly three times as much as benefits that go to low- to moderate-income families. In addition, middle- and upper-income families reap the majority of benefits from the child tax credit and the child care and dependent tax credit because neither is fully refundable.

In short, high rates of child poverty and income inequality in the U.S. can be reduced, but effective, widespread, and long-lasting change will require shifts in both national policy and the economy.

9. Why should Americans care about family economic hardship?

In addition to the harmful consequences for children, high rates of economic hardship exact a serious toll on the U.S. economy. Economists estimate that child poverty costs the U.S. $500 billion a year in lost productivity in the labor force and spending on health care and the criminal justice system. Each year, child poverty reduces productivity and economic output by about 1.3 percent of GDP.

The experience of severe or chronic economic hardship limits children’s potential and hinders our nation’s ability to compete in the global economy. American students, on average, rank behind students in other industrialized nations, particularly in their understanding of math and science. Analysts warn that America’s ability to compete globally will be severely hindered if many of our children are not as academically prepared as their peers in other nations.

Long-term economic trends are also troubling as they reflect the gradual but steady growth of economic insecurity among middle-income and working families over the last 30 years. Incomes have increased very modestly for all but the highest earners. Stagnant incomes combined with the high cost of basic necessities have made it difficult for families to save, and many middle- and low-income families alike have taken on crippling amounts of debt just to get by.

Research also indicates that economic inequality in America has been on the rise since the 1970s. Income inequality has reached historic levels — the income share of the top one percent of earners is at its highest level since 1929. Between 1979 and 2006, real after-tax incomes rose by 256 percent for the top one percent of households, compared to 21 percent and 11 percent for households in the middle and bottom fifth (respectively).

Economic mobility—the likelihood of moving from one income group to another—is on the decline in the U.S. Although Americans like to believe that opportunity is equally available to all, some groups find it harder to get ahead than others. Striving African American families have found upward mobility especially difficult to achieve and are far more vulnerable than whites to downward mobility. The wealth gap between blacks and whites — black families have been found to have one-tenth the net worth of white families — is largely responsible.

What all of these trends reveal is that the American Dream is increasingly out of reach for many families. The promise that hard work and determination will be rewarded has become an increasingly empty promise in 21st century America. It is in the best interest of our nation to see that the American Dream, an ideal so fundamental to our collective identity, be restored.

10. What can be done to increase economic security for America’s children and families?

A considerable amount of research has been devoted to this question. We know what families need to succeed economically, what parents need to care for and nurture their children, and what children need to develop into healthy, productive adults. The challenge is to translate this research knowledge into workable policy solutions that are appropriate for the US.

For families to succeed economically, we need an economy that works for all — one that provides workers with sufficient earnings to provide for a family. Specific policy strategies include strengthening the bargaining power of workers, expanding the Earned Income Tax Credit, and increasing the minimum wage and indexing it to inflation. We also need to help workers get the training and education they need to succeed in a changing workforce. Dealing with low wages is necessary but not sufficient. Low- and middle-income families alike need relief from the high costs of health insurance and housing. Further programs that promote asset building among low-income families with children are also important.

As a nation, we also need to make it possible for adults to be both good workers and good parents, which requires greater workplace flexibility and paid time off. Workers need paid sick time, and parents need time off to tend to a sick child or talk to a child’s teacher. Currently, three in four low-wage workers have no paid sick days.

Despite the fact that a child’s earliest years have a profound effect on his or her life trajectory and ultimate ability to succeed, the U.S. remains one of the only industrialized countries that does not provide paid family leave for parents with a new baby. Likewise, child care is largely private in the U.S. — individual parents are left to find individual solutions to a problem faced by all working parents. Low- and middle-income families need more help paying for child care and more assistance in identifying reliable, nurturing care for their children, especially infants and toddlers.

These are only some of the policies needed to reduce economic hardship, strengthen families, and provide a brighter future for today’s — and tomorrow’s — children. With the right leadership, a strong national commitment, and good policy, it’s all possible.