Learn about our Making Work Supports Work project.

This is an excerpt from the full report.

To better understand poverty and find the best strategies to reduce it, states and localities need to know who is poor, why they are poor, and what policies work best for different groups. Rather than rely on the official poverty measure, in use since the early 1960s, several states and localities have taken the lead in developing new measures of poverty that more accurately account for the resources available to their residents as well as their needs. Supported by a strong body of innovative research from the federal government and public policy research organizations, these new measures not only more accurately gauge the level of poverty but offer a cost-effective way to evaluate the effectiveness of anti-poverty programs. Improved poverty measurement also helps policymakers identify effective new programs to assist vulnerable populations in meeting their families’ often-pressing needs.

This brief provides an up-to-date look at how pioneering states and localities are using – or plan to use – improved poverty measurement to build smarter social policy. In a difficult fiscal climate, investing in better measures to estimate poverty and evaluate the effectiveness of anti-poverty programs is sound practice that will enable policymakers to quantify whether and how interventions are improving outcomes for children and their families.

How the Official Poverty Measure Falls Short

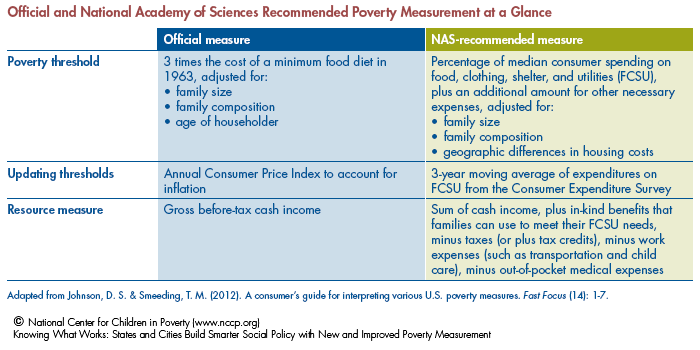

The official poverty rate is determined by comparing a family’s pre-tax cash income to an income poverty threshold. If a family’s income falls below this threshold, it is considered to be poor. This threshold was developed in the 1960s and sets the poverty line at three times the cost of a basic food basket, because food was then found to account for one-third of the cost of living. Since then, the threshold has only been adjusted to account for inflation, despite the fact that food now accounts for only one-seventh of the cost of living.

This threshold has become an inaccurate measurement tool, providing a flawed accounting of both family needs and family resources. On the needs side, it fails to consider the growing burden of nondiscretionary expenses for such necessities as housing, child care, out-of-pocket medical expenses, and transportation. Nor does it account for variations in the cost of living based on geographic location. On the resource side, the official poverty measure also falls short. It counts the pre-tax, cash income of a family, which includes earnings, dividends, interest, Social Security 4 National Center for Children in Poverty payments, and pensions, among other income, as well as any public assistance, Supplemental Security Income (SSI), alimony, and child support payments a family receives. However, the official measure excludes post-tax cash benefits like the Earned Income Tax Credit (EITC) and the refundable portion of the child tax credit, and ignores in-kind government benefits like the Supplemental Nutrition Assistance Program (SNAP, or food stamps), Medicaid, housing subsidies, school lunch assistance, and child care assistance.

Clearly, the limitations of the official measure pose an obstacle to designing and evaluating anti-poverty policy at all levels of government. An unrealistic poverty threshold on the needs side and the exclusion of important income and work supports on the resource side are producing a flawed accounting of who is poor. In addition, since the official measure does not factor in a number of important government programs intended to assist low-income families, it is difficult to assess what programs are effective at reducing poverty. All of these deficiencies point to the need for an improved poverty measure, one that can not only help policymakers and the public gain a better understanding of who is actually living in poverty and the expenses that are pushing people into poverty, but also what government programs are effective in preventing or alleviating poverty at the national, state, and local levels.

A Proposal for Improving Poverty Measurement

More than 17 years ago, in an effort to rectify the limitations of the official poverty measure, the National Academy of Sciences (NAS) made detailed recommendations on how poverty in America might be more accurately measured. The NAS recommendations were drafted in 1995 at the request of Congress and since then, governmental and non-governmental poverty research organizations have developed a range of poverty measures broadly based on the NAS proposal.

While these measures differ in important ways, they generally have the following features: On the needs side of the poverty equation, they account for the cost of food, clothing, shelter, and utilities, based on data provided in the Consumer Expenditure Survey; they adjust for regional variation in housing expenses; they account for out-of-pocket medical expenses; and they include work-related expenses (for example, child care and transportation). On the resources side, they adjust for post-tax income – including tax credits – and account for both housing assistance and nutritional assistance (such as SNAP, school lunches, and the Special Supplemental Nutrition Program for Women, Infants and Children program [WIC]).